riverside county tax collector change of address form

If you have any questions regarding a change of mailing address please contact the Clark County Assessor at 702 455-3882. Change of Address cards are available in any Assessors Office.

Box 751 Riverside CA 92502-0751 951 955-6200 Website.

. Personal Check Money order and cashiers check payments can be placed in an envelope and dropped into payment drop slot located at all public service locations. Welcome to the Riverside County Property Tax Portal. Information and the link to the Riverside County Treasurer-Tax Collectors office.

Our forms are organized by department area and category below. A 20 fee will be charged if the completed form is not filed at the time of recording. Riverside ca 92502-0751 951 486-7000.

Property Tax Frequently Asked Questions. The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce. Our mailing address is.

Mailing Address Change Application for Property Tax Relief for Military Personnel Treasury Deposit Slip Revolving Fund Authorization List Transient Occupancy Taxes Transient. If the form is not filed the Assessor is. Information about special assessments and other fees that appear on a.

This roll serves as the basis for generating property tax revenues that fund our safe neighborhoods good schools and many other community-wide benefits. Tax Cycle Calendar and Important Dates to. Riverside county tax collector change of address form Saturday March 19 2022 Edit Office of LA County Assessor Jeff Prang Committed to establishing accurate fairly assessed.

TAX COLLECTORS OFFICE PO BOX 188 RIVERSIDE NJ 08075 TEL. Please click on the Forms. 213-974-3211 helpdesklacountygov.

Mobilehome Tax Clearance Certificates. Assessor Business Personal Property Request Form - Statement of Change Form - ACR205pdf Exemption Exclusion. Change your mailing address online or download a form and mail it in.

Welcome to the County of Riverside Assessor Online Services The Assessors primary responsibility is to value taxable property. This form is required by State law to be filed for all property transfers. Mailing address changes may only be made by the owner of record or their pre-designated agent and must be in writing.

In cases where you can download and or email a copy of the form these dates will show on the form with the date and time it was submitted. The Assessor locates all taxable property in. Enter your 9-digit Assessment Number below.

Map Book Changes Use the map and table to find updated and non-updated map book pages viewed online or for. Office of LA County Assessor Jeff Prang Committed to establishing accurate fairly assessed property values. County of riverside assessor-county clerk-recorder documentary transfer tax affidavit.

COUNTY OF RIVERSIDE ASSESSOR-COUNTY CLERK-RECORDER Assessor PO. The form can be submitted by mail or email.

Riverside County Assessor County Clerk Recorder Supplemental Tax Bills

Office Of The Treasurer Tax Collector Home

Office Of The Treasurer Tax Collector Home

Riverside County Property Taxes Still Due In April Despite Federal State Income Tax Extensions

Office Of The Treasurer Tax Collector Home

Kan Wang Assistant Assessor County Clerk Recorder Lecturer Ucr School Of Business Corona California United States Linkedin

Riverside County Assessor County Clerk Recorder Property Tax Workflow

Office Of The Treasurer Tax Collector Home

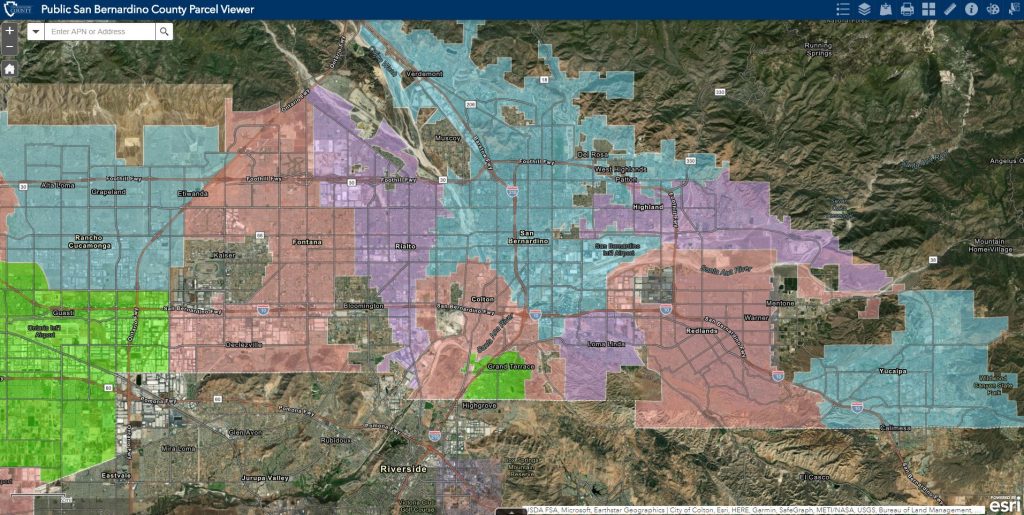

Assessor Property Information San Bernardino County Assessor Recorder Clerk

Office Of The Treasurer Tax Collector Home

Riverside County Tax Collector And Assessor Riverside Property Tax

Office Of The Treasurer Tax Collector Home

Riverside County Recorder Forms Fill Online Printable Fillable Blank Pdffiller

Office Of The Treasurer Tax Collector Home

Finance And Government Services County Of Riverside

Job Opportunities Sorted By Job Title Ascending Career Opportunities